Navigating CPT 99490: 2025 Compliance and 2026 Proposed Rule Impacts

The landscape of chronic care management (CCM) continues to evolve. In fact, Medicare’s fee-for-service model now recognizes the value of non-face-to-face care coordination. CPT code 99490 is a foundational component. This code enables practices to get reimbursed for crucial services. It supports patients with multiple chronic conditions. The right approach can improve patient outcomes and practice revenue. This requires understanding current and upcoming CMS regulations. This guide provides a clinical and operational overview.We’ll walk through billing rules, workflow design, operational tips, and how SmartCare360 can support integrated documentation—without stepping into the treatment provider role. We will examine 2025 guidelines and potential 2026 changes. The goal is to empower your practice with a roadmap for compliant, effective CCM.

What Is CPT 99490 and Who Is Eligible?

Defining CPT code 99490 for Chronic Care Management

CPT code 99490 is a core component of Medicare’s Chronic Care Management program. It compensates for non-face-to-face care. This includes clinical staff time spent on behalf of a patient. The code covers the first 20 minutes of a calendar month. Activities include care plan development and care coordination. The clinical staff must, in fact, be directed by a physician or other qualified healthcare professional. This model supports consistent, proactive care. It addresses the needs of patients with complex health requirements.

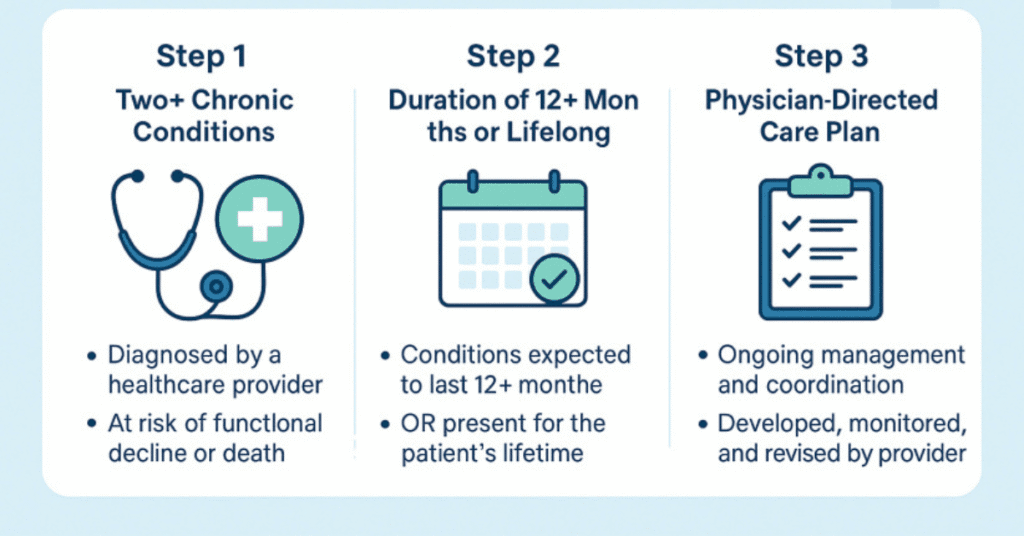

Patient Eligibility Requirements

Patients must meet specific criteria to be eligible for CPT 99490. They must have two or more chronic conditions. These conditions must be expected to last at least 12 months. CMS defines “chronic” as conditions that, in fact, place the patient at significant risk. This includes risk of death, exacerbation, or functional decline. A comprehensive care plan must be established for the patient. This plan should address all of their qualifying chronic conditions. The physician is, as such, responsible for creating and directing this plan.

2025 CPT 99490 Billing Guidelines and Reimbursement

Understanding the 2025 Reimbursement Landscape

The 2025 national average reimbursement rate for CPT code 99490 is approximately $60. This amount can actually vary based on geographic practice locality. It is important to note the changes for Rural Health Clinics (RHCs) and Federally Qualified Health Centers (FQHCs). Starting in 2025, they will transition from code G0511. RHCs and FQHCs now bill the same CPT codes as other fee-for-service practices. This change, to be fair, standardizes billing practices across different care settings.

CPT 99490 Billing Compliance Checklist

Comparative Matrix of CPT 99490, 99439, 99491, and 99487

| CPT Code | Time Requirement | Estimated 2025 Reimbursement | Supervision & Billing Logic |

|---|---|---|---|

| 99490 | ≥ 20 minutes/month | $62.00 (avg.) | Clinical staff under general supervision of a physician/QHP |

| 99439 | Each additional 20 minutes | $47.50 (avg.) | Same rules as 99490; billed in conjunction with 99490 |

| 99491 | ≥ 30 minutes/month | $84.00 (avg.) | Time personally provided by physician/QHP (not clinical staff) |

| 99487 | ≥ 60 minutes/month (Complex CCM) | $95.00 (avg.) | Requires moderate/high complexity medical decision making; clinical staff time with general supervision |

Essential Billing and Documentation Rules

Accurate documentation is the foundation of compliant billing. To submit a claim for 99490 CPT codes, a practice must demonstrate 20 minutes of clinical staff time. This time must be spent on non-face-to-face CCM services. Documentation should detail the activities performed. The use of a certified EHR system is highly recommended. A checklist for claim submission includes documented patient consent and, as such, the use of appropriate modifiers.

Navigating Consent and Patient Enrollment

Documented patient consent is mandatory for CPT 99490. This consent must be obtained before initiating services. Practices must inform the patient about the program details. This includes an explanation of cost-sharing requirements. Patients must also be aware they can terminate their participation at any time. This consent process must be clearly recorded in the patient’s medical record. It is, in fact, a key requirement for audit-readiness and compliance.

CPT 99490 vs. 99491: Key Differences for Practice Use

Differentiating Non-Complex CCM Codes

CPT 99490 and 99491 are both for non-complex CCM. The key distinction lies in who performs the service. 99490 CPT covers clinical staff time. It requires a minimum of 20 minutes per calendar month. CPT 99491 is for services personally provided by the physician or QHP. This code, to be fair, requires at least 30 minutes of provider-specific time. These codes are mutually exclusive. A practice cannot, in fact, bill both for the same patient in the same month.

CPT 99490 vs. 99491 Comparison

| Feature | CPT 99490 | CPT 99491 |

|---|---|---|

| Time Requirement | 20 minutes/month (minimum) | 30 minutes/month (minimum) |

| Billing Provider | Clinical staff under direction of physician/QHP | Physician/QHP personally provides |

| Service Type | Non-face-to-face services | Non-face-to-face services |

| Reimbursement Rate (Avg. 2025) | ~$60 | ~$83 |

The Role of Telehealth and Technology

Integrating Telehealth with Chronic Care Management

CPT 99490 services are inherently non-face-to-face. This makes them, as such, ideal for telehealth integration. Services can be furnished via phone calls, secure messaging, or remote patient monitoring. CMS guidelines explicitly allow this. The 2025 telehealth codes may offer new opportunities. They can provide additional ways to engage patients remotely. Understanding how these codes interact is crucial. They can support, but do not replace, the core CCM services.

Using Technology for Seamless Compliance

Effective CCM depends on accurate time tracking and documentation. Dedicated practice management software is essential. Tools like SmartCare360 support automated time tracking. They also help with documenting patient consent and care plan activities. This ensures compliance with complex CMS rules. For specialty practices, a monitoring solution can be particularly useful. It can collect patient data, helping to meet the 20-minute time requirement. This technology provides a clear audit trail, to be fair.

Looking Ahead: 2026 Proposed Rule Impacts

Analyzing Potential Changes to Reimbursement

The CMS 2026 Proposed Rule outlines several key changes. The Physician Fee Schedule’s conversion factor may change. There could be different conversion factors for qualifying and non-qualifying APM participants. This could directly affect the reimbursement rate for CPT 99490. Practices should, in fact, monitor these developments closely. A change in the conversion factor impacts all services. It requires practices to be adaptable in their financial planning.

Broader Implications for Care Management Programs

The 2026 proposed rule may introduce new codes. These could include Advanced Primary Care Management (APCM) codes. These changes could, in fact, alter the landscape of care management. The rule may also affect how remote monitoring services are integrated. It might modify time requirements for certain codes. Practices must stay informed about these proposals. Proactive planning helps maintain effective care management programs and billing strategies

FAQ's

What is the primary difference between CPT 99490 and RPM codes?

CPT 99490 is a time-based chronic care management code. It covers non-face-to-face care coordination activities like phone calls and documentation. RPM codes, like CPT 99457, are for active patient monitoring. They require a specific amount of interactive communication. While they can, in fact, overlap, they are billed for distinct services.

Can CPT 99490 be billed for a patient already in a home health program?

No. CPT 99490 cannot be billed during the same calendar month as certain other services. This includes home health care supervision (G0181) and transitional care management (TCM) codes. The care coordination services must not, as such, overlap with other billable programs.

How do I prove the 20-minute time requirement for an audit?

Accurate, detailed time logs are essential. Documentation should include the date, time spent, and activity performed. An automated solution can track these services. It provides a clear, defensible record. This record must be easily accessible within the patient’s medical record.

Can a single practice bill for both CPT 99490 and another code like CPT 99491?

No. A practice cannot, actually, bill for both CPT 99490 and 99491 for the same patient. These are mutually exclusive codes. CPT code 99490 covers clinical staff time. CPT 99491 covers physician or QHP time. A practice must choose which code best fits the care provided that month.

What are the key components of a comprehensive care plan?

A comprehensive care plan is, to be fair, patient-specific. It must address all chronic conditions. It should include a problem list and expected outcomes. The plan must also detail planned interventions. A list of responsible individuals should be included. It is, in fact, a central element of the CCM program.